MD DLLR Wage Claim Form Instructions 2013-2024 free printable template

Show details

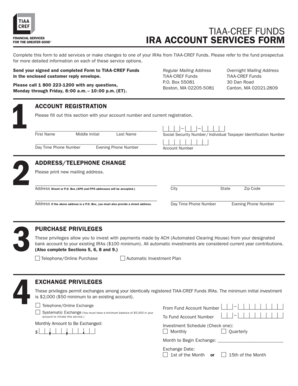

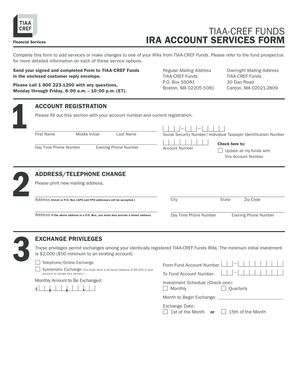

EMPLOYMENT STANDARDS SERVICE 1100 N. UTAH STREET, ROOM 607 BALTIMORE, MD 21201 410-767-2357 phone 410-767-2117 TTY Instructions for Completing the Wage Claim Form Please Read Carefully This form must

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your maryland wage claim form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland wage claim form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maryland wage claim form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit md wage form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

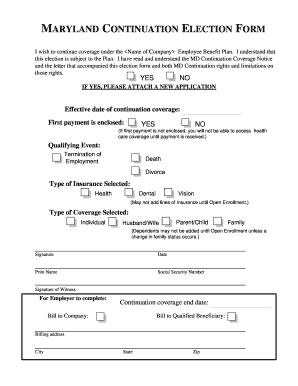

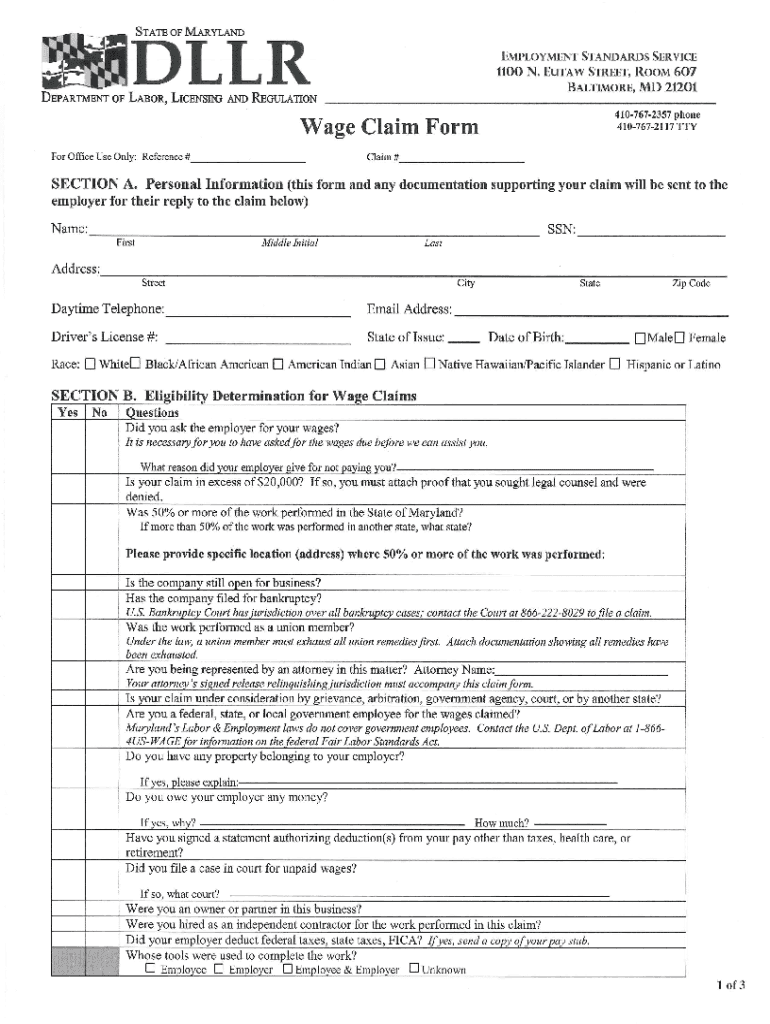

How to fill out maryland wage claim form

How to fill out Maryland wage form:

01

Obtain the Maryland wage form from the appropriate government agency or website. It is usually available online or can be requested in person or by mail.

02

Start by carefully reading and understanding the instructions provided with the form. This will ensure that you correctly fill out all the necessary sections.

03

Fill in your personal information, such as your name, address, and social security number, in the designated fields on the form.

04

Provide details about your employment, including your employer's name, address, and federal employer identification number (FEIN).

05

Indicate the dates of your employment and the total amount of wages earned during the specified period.

06

If applicable, report any deductions or exemptions that may apply to your wage calculation. These can include pre-tax deductions, allowances, or garnishments.

07

Double-check all the information you have entered to ensure its accuracy and completeness.

08

Sign and date the form in the appropriate section to confirm that the information provided is true and accurate to the best of your knowledge.

Who needs the Maryland wage form:

01

Employees residing in Maryland who require an official record of their wages and employment details may need to fill out the Maryland wage form.

02

Employers in Maryland may need the wage form to accurately report their employees' wages and comply with state employment laws.

03

Individuals or organizations, such as government agencies or financial institutions, requesting wage verification may require the completed Maryland wage form.

Fill md dllr wage claim form : Try Risk Free

People Also Ask about maryland wage claim form

What is the statute of limitations on unpaid wages in Maryland?

What is required on a pay stub in Maryland?

What is the Maryland Unpaid wages Act?

What are Maryland State payday requirements?

How do I file a wage complaint in Maryland?

What is the wage collection law in Maryland?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

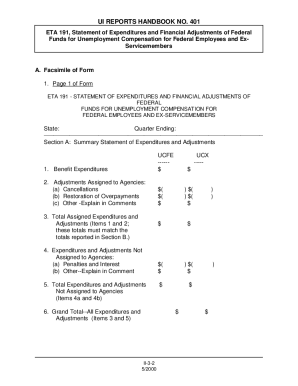

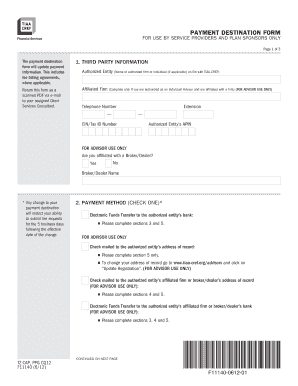

What information must be reported on maryland wage form?

The information required to be reported on Maryland wage forms includes: the employer’s name, address, and federal employer identification number (FEIN); the employee’s name, address, and Social Security number; the total amount of wages paid during the pay period and the total amount of taxes withheld; the type and amount of any withholding allowances claimed; the total amount of taxable wages; and the total amount of taxes withheld.

What is maryland wage form?

There isn't a specific form called the "Maryland wage form." However, the State of Maryland does require employers to report wage information for their employees. This is typically done using the state's quarterly wage reporting form, known as the "Employer Contribution and Wage Report." This report is used to determine the amount of unemployment insurance taxes that employers owe and to verify wages for benefits claims. It includes information such as the employee's name, social security number, gross wages, and hours worked.

Additionally, Maryland employers are required to provide their employees with a Wage Payment and Collection Act notice, which outlines important wage-related information such as pay rates, pay periods, and deductions.

It's important to note that wage reporting and payment regulations may vary depending on the specific circumstances and industry. It is recommended to consult with the Maryland Department of Labor or a qualified professional for specific guidance and applicable forms.

Who is required to file maryland wage form?

Employers in the state of Maryland are required to file the Maryland Wage Form. This form, also known as the MW 506, is used to report and pay state income taxes withheld from employees' wages.

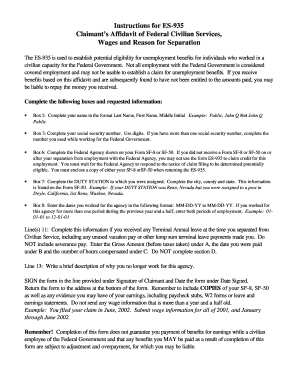

How to fill out maryland wage form?

To fill out the Maryland wage form, follow these steps:

1. Obtain the Maryland wage form: Visit the Maryland Department of Labor website or contact your employer to obtain the correct wage form. Typically, the form is titled "Maryland Wage Claim Form" or "Maryland Wage Complaint Form."

2. Provide your personal information: Start by providing your full name, current address, phone number, and email address. Ensure that the information is accurate and up to date.

3. Enter your employer's information: Fill in your employer's name, address, phone number, and any other required details. Make sure to provide the correct information to avoid delays in the processing of your claim.

4. State the nature of your claim: Specify the reason for filing the wage claim, such as unpaid wages, unpaid overtime, unpaid vacation pay, or any other relevant wage-related issue.

5. Describe the details of your claim: Provide a detailed description of the circumstances surrounding your claim. Include dates, amounts, and any other relevant information that supports your claim. Be as specific and concise as possible.

6. Calculate the amount owed: Determine the total amount of wages you believe you are owed. This can include regular wages, overtime pay, unpaid vacation or sick leave, or any other type of compensation owed to you. Calculate each category separately and sum them up for the total amount.

7. Provide supporting documents: Attach any relevant documents that support your claim, such as pay stubs, timecards, employment agreements, or any other evidence of your work and wages.

8. Sign and date the form: After reviewing all the information you have provided, sign and date the form to certify that all the information is accurate and true to the best of your knowledge.

9. Submit the form: Submit the completed wage form to the Maryland Department of Labor's Wage and Hour Compliance Division according to the instructions provided on the form. Ensure that you keep a copy of the form for your records.

It is advisable to consult with an employment attorney or contact the Maryland Department of Labor for any specific guidance or clarification before submitting your wage claim form.

What is the purpose of maryland wage form?

The purpose of the Maryland Wage Form, also known as the MW507 form, is to provide information to employers about an employee's Maryland state tax withholding requirements. It is used by employees to indicate their filing status, exemptions, and any additional amounts they want to withhold from their wages for state taxes. The form ensures that employers withhold the correct amount of Maryland state tax from an employee's paycheck and helps individuals avoid underpayment or overpayment of state taxes.

When is the deadline to file maryland wage form in 2023?

The deadline to file the Maryland wage form in 2023 is not readily available as it may vary depending on the specific wage form being referred to. It is recommended to check the official Maryland Department of Labor, Licensing, and Regulation (DLLR) website or consult with a tax professional to obtain the accurate deadline for filing the specific wage form needed.

What is the penalty for the late filing of maryland wage form?

According to the Maryland Department of Labor, the penalty for late filing of the Maryland Wage and Hour Division forms is $20 for each day the report is late, but not exceeding $1000. Additionally, if there is willful failure to file a report, the penalty can be up to $5,000. It is important to note that these penalties are subject to change, so it is advisable to check with the Maryland Department of Labor for the most up-to-date information.

How can I get maryland wage claim form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific md wage form and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my wage claim form maryland in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your maryland wage claim and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit md dllr claim on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute md wage claim form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your maryland wage claim form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wage Claim Form Maryland is not the form you're looking for?Search for another form here.

Keywords relevant to maryland wage form

Related to wage claim maryland

If you believe that this page should be taken down, please follow our DMCA take down process

here

.